During the (brief) discussion prior to the passage of tax reform in December, 2017, there was some concern that a tax reform which lowered corporate tax rates would substantially increase the US deficit, and contribute too much to the national debt. Many reasonable people had this concern, and it is something real to be concerned about.

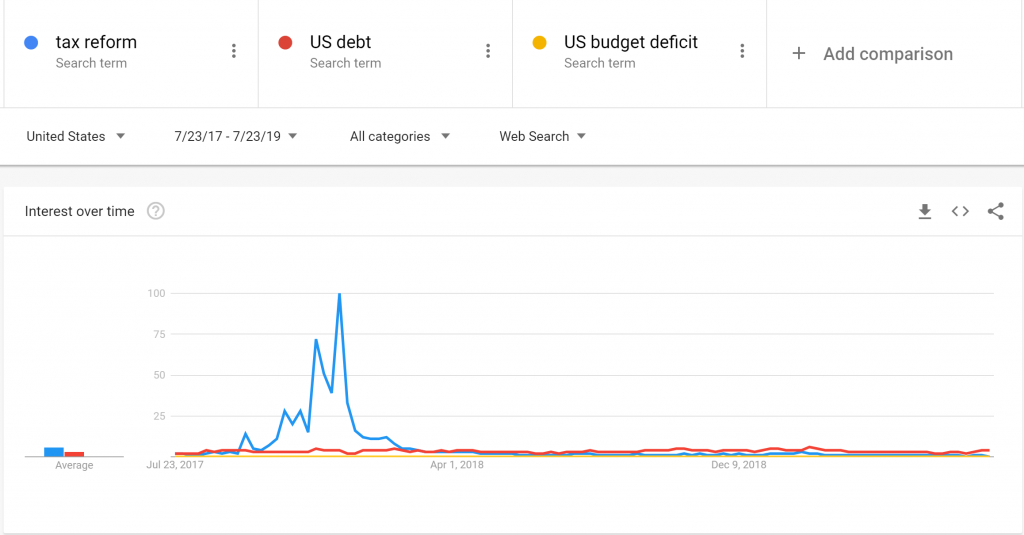

Here is an interesting graph:

For as much as policy-wonk-types were worried about the deficit or debt, how much were ordinary people worried about it? If you take the frequency with which people searched for debt and deficit-related terms, basically zero. When during the year do ordinary people worry about it? Basically never. Which is why it has not been resolved—we live in a democracy, and unless the people are collectively really sincerely worried about something, they will probably not get much action on it.

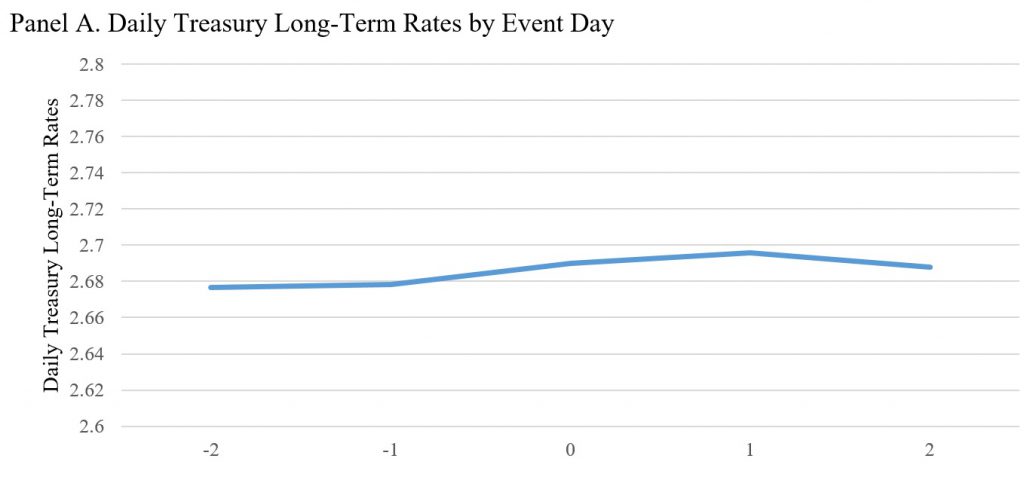

The various groups that scored Tax Reform certainly had estimates of what it would do the debt. I am not going to go into that evidence here. I will note, however, that the market for Treasuries did not seem to think tax reform was much of a concern. In this paper, the online appendix has some evidence which suggests that on the key dates leading up to tax reform, the yield on treasuries did not change. The graph is basically a flat line:

The default risk of the US government was not perceived as increasing. And, rather than being policy-folks making the prediction, it was the very people who stood to make or lose money if they ended up being wrong (those holding the notes). They could certainly be wrong, but they were not betting on increased likelihood of default.

Of course, there are many states of the economy which are very bad which could be the result of overspending (or undercollecting revenue) that do not result in default. But, there is no well defined market for observing traders perceptions regarding those outcomes. And, of course, even if tax reform did not cause long-term fiscal problems, there is still the question of the distributional impact of the TCJA. But, again, there is no place where informed people bet a lot of money on that. There is for the default risk of the US government.